What makes one investor stick with their strategy through market swings while another panics and pulls out?

Often, it comes down to mindset.

Your investing

Tax season might not spark joy, but a refund sure can.

In 2025, the IRS estimates the average federal income tax refund will top $3,170.1 That means a lot of

What do you do when faced with a complex financial challenge?

Do you seek an immediate solution, or do you take the time to fully understand the issue before

Tax season doesn’t have to feel like an uphill battle. With the right strategies, you can minimize your tax bill and keep more of your hard-earned money where

Markets have been on a roller coaster, and investors are asking:

Is a bear market on the way?

Read More

It’s been hard to miss the wave of attention-grabbing headlines lately. News cycles have been dominated by concerns over Big Tech’s earnings, trade tensions

Read More

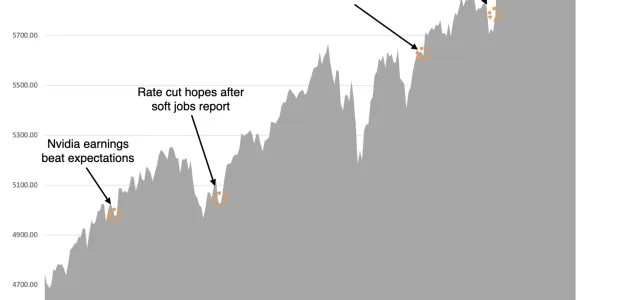

As we step into 2025, I thought it would be beneficial to take a moment and reflect on what an extraordinary year 2024 was for investors.

Read More

How many years will your retirement last? Most of us answer those questions wrong because we don’t have strong longevity literacy.

Read More

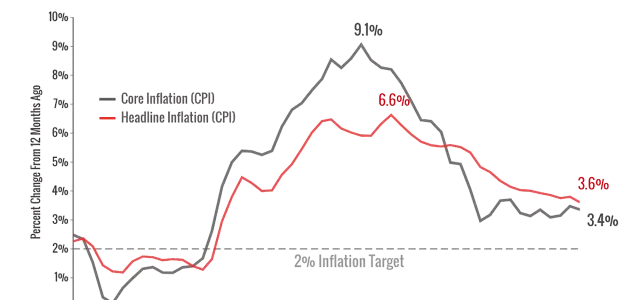

After months of simmering inflation reports, it looks like inflation finally eased slightly in April. Are prices stabilizing? Let’s dig a little deeper.

Read More

Markets have been very volatile lately. What’s going on? Let’s take a quick look at the factors that are influencing markets right now.

Read More

As 2022 is coming to a close, deadlines for your personal finances are rapidly approaching.

Read More

The markets are unfortunately off to a disappointing start in 2022 much like I warned about in my autumn update and various conversations with you.

Read More